Services

We are here to help

LETTER OF CREDIT :

HESPA Trade finance will arrange LC AT SIGHT,SBLC,BG,DLC,UPASS,USANCE,BCL,PG,POF and other bank instruments for clients without credit lines and these instruments can be used for Import, Export, PPP and Loan collateral.

Hespa Trade Finance is only open to dealing with clients with special requests for any bank instruments and the client must be ready to make the upfront financial commitment.

Hespa Trade Finance can get the instrument you require. We have so many banks in the world.

Apply Now

In what situations would I use a standby letter of credit?

A standby LC provides security to a beneficiary in that promises to pay the beneficiary upon presentation of pre-specified documents. The following are some instances where standby letters of credit are used: – The buyer to purchase goods without having to make a cash deposit – Performance-related during the tender process of a contract – Support contractual / payment obligations Can a standby letter of credit be canceled before expiry? Yes. A standby letter of credit can be canceled before expiry by having the beneficiary return the original standby LC to the Trade Finance division along with a letter printed on the beneficiary’s letterhead, addressing their agreement to the standby letter of credit cancellation.

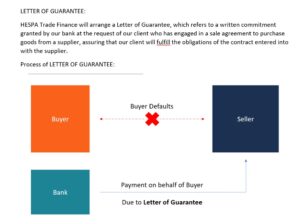

Letters of guarantee

What is URDG?

The uniform rules for demand guarantees, developed by the ICC, are used by banks and businesses across continents and industry sectors. A demand guarantee is an independent undertaking where guarantors are assured that their commitment is subject to its own terms.

What is required to issue a guarantee?

A bank guarantee request has to be approved by the bank. Normally you get an offer letter for a specific guarantee or you will get an offer letter for a guarantee facility up to a certain limit. As a customer, you must provide us with at least the following information: Name and address of debtor/principal, Name and address of the beneficiary, Guarantee amount, Expiry date, What the guarantee is related to (e.g. the underlying contract) and Type of guarantee (e.g. performance, payment or advance payment).

What is the price for a guarantee?

The pricing of a guarantee depends on the amount and length of the guarantee, the type of guarantee, what kind of security the bank receives, the general market situation, and the specific situation for your line of business.

How do I claim a guarantee?

A claim is brought against the guarantor when the beneficiary believes the principal has defaulted with the underlying conditions covered by the guarantee. The claim must state: a reference to the guarantee in question, how the principal has defaulted on the underlying agreement covered by the stated guarantee, and if possible documentation: the amount claimed under the guarantee and to which account the money should be credited.

How long time it will take to be paid after claim has presented i.e. when will the bank pay?

Payment will depend on if the guarantee is an accessory or demand guarantee. A demand under an accessory guarantee will be paid when one of the following conditions is true: amicable agreement (e.g. the principal accepts the demand), final judgment in court, or arbitration award. Payment under a demand guarantee will depend on the wording of the guarantee, describing what must be presented and when payment should be made.

What documentation does HESPA need to cancel a guarantee with an open-ended date?

If the guarantee is open ended (i.e. no expiry date), we need either the original guarantee document returned to us or that the beneficiary in writing states that HESPA is released from our obligations.

OVERDRAFT:

HESPA Trade Finance will arrange an overdraft fund when our client doesn’t have enough money in their account to cover a transaction, but the bank pays the transaction anyway

BUSINESS ACCOUNT

HESPA Trade Finance will arrange for UAE or abroad to open a business account for your client’s request.

HESPA Trade Finance consultants can support you with company incorporation and bank account opening in UAE.

HOW TO OPEN BUSINESS BANK ACCOUNT IN UAE/ CORPORATE BANK ACCOUNT IN UAE:

UAE is one of the leading investor’s friendly business hub in the world. Bank accounts in the UAE offer investors and companies very customer-friendly and hassle-free services once the applicant meets KYC requirements by the banks. We at HESPA Finance can guide you on KYC requirements, prior to starting the bank account opening in the UAE and it makes easy documentation process for the applicants:

Documents required for a business bank account in the UAE:

1) Copy of valid trade license.

2) Copy of MOA/ AOA.

3) Copy of share certificate.

4) Copy of incorporation certificate.

5) Copy of passport.

6) Copy of Emirates ID. 7) Copy of visa page.

8) List a few prospective clients/ or existing clients.

9) Copy of last 6 months’ bank statements.

10) Copy of Tenancy certificate.

Insurance:

HESPA Trade Finance specializes in providing comprehensive insurance solutions tailored to meet the unique needs of diverse projects. Whether it’s infrastructure, green initiatives, agriculture endeavors, or energy projects, our team leverages its deep understanding of the insurance landscape to offer optimal coverage options. With a focus on mitigating risks and ensuring project viability, we employ a variety of innovative insurance structures and strategies. From project inception to completion, our expertise and industry insights enable us to navigate complex challenges and facilitate seamless financial arrangements, safeguarding investments and promoting sustainable project outcomes.

Performance bond :

HESPA Trade Finance will arrange a performance bond finance facility against the failure of the other party to meet its obligations. It is also referred to as a contract bond. A bank or an insurance company usually provides a performance bond to make sure a contractor completes designated projects.

Project Finance:

HESPA Trade Finance will arrange Project Finance on long-term limited recourse financing of infrastructure, green project, agriculture project and energy related projects. With our Project Finance expertise and wide-ranging industry experience, we offer various alternative transaction structures to achieve successful financial closure within the project timeline.

Financing and Investment Consulting

1. HESPA Trade Finance offers financing with a minimum contribution of the Project Initiator (Promoter) for any industry: agriculture, real estate, energy, mining, chemical wastes, industrial, machinery, infrastructure, logistics, etc.

* Investments: from €10 million and more.

* Loan amount: up to 85% of the project cost.

* Loan duration: from 8 to 20 years.

* Comprehensive consulting services.

To consider your application, please provide us with a presentation/description of your investment or business project, fill out the form, and send it to us by e-mail (info@hespafinance.com).

Please note: if the client does not have liquid assets, the application will not be processed.

We employ top-level professionals and asset managers who study every specific case providing a financial solution that allows the Promoter to finance the project in the long term with the minimum possible contribution.

2. Contribution of the Promoter (Initiator) to the Project prior to obtaining a building permit.

In all cases, the Promoter must cover the running costs prior to obtaining a construction permit. These costs will be considered the contribution of the Promoter to the Project. The cost of land or obtaining rights to it is also paid by the Promoter.

It is supposed to study which option is most convenient for the Promoter in each case.

3. A flexible combination of Bank Financing and contributions from Financial Investors is proposed for the period of construction and at least 05 years of operation of the facility, replacing the traditional Project Financing.

HESPA will be created only for the construction of the project in which the loan guarantor will have a majority stake only during the construction period. The necessary credit will be insured by external guarantees in such a way that the Promoter´s Bank will have no problem in financing the construction.

At the end of the Construction the Assets will be acquired by an Investor who will receive an annual income for at least 5 years, giving the option to buy back the Asset to the Operating Company. The future annual income of the Investor must have a guarantee from the Operator´s Bank.

4. Procedure to carry out until the operation of the business.

An exclusive collaboration agreement will be signed between the Initiator (Promoter) and our company jointly with the advisory financing and investment structuring company proposed by us.

In this agreement all the steps and conditions necessary to obtain the financing are foreseen:

* Advice on hiring of the construction company.

* Obtaining a conditional offer from the Bank to finance the construction of the project.

* Obtaining a conditional offer from the Bank to ensure the future annual income of the Financial Investor for the exploitation period.

* Obtaining a non-binding offer from the Financial Investor.

* Preparation of the final Business feasibility study.

* Obtaining the Credit Guarantees and financing for construction.

* Obtaining the Financial Investor for the exploitation period of the business.

* Agreement for the establishment and management of a HESPA in charge of financing and carrying out the construction of the project.

* Advise the agreement between the Promoter, business Operator, and Financial Investor for the exploitation period.

* Advice for the use of international legal and commercial instruments until the start of business operation.

All the financial and structuring costs will be included in the Project financing budget and deducted from the financing granted.

Contact our Customer Service for more information.

Fees & Charges

The commission rate is based upon the risk assumed by collateral and your financial strength.

Other charges may include correspondent bank charges and expenses relating to the bank facilities such as courier, swift charges, etc.

How Do I Get it

For more information on how to request any Trade Finance service or document for your business please contact your Business Relationship Officer or you can email enquiries to info@hespafinance.com.